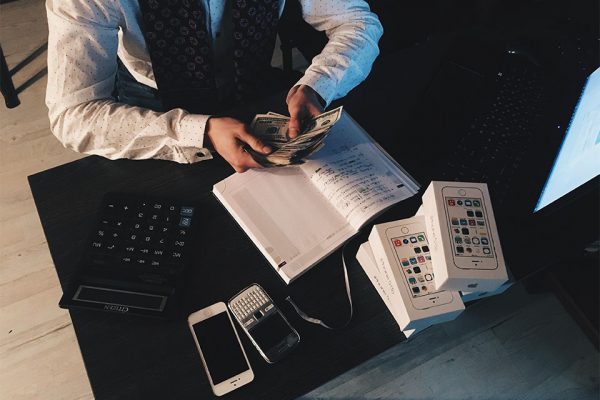

If you’re a business owner, bookkeeping is likely one of the least exciting tasks on your plate. But while it may not be the most fun thing to do, it’s still important – and neglecting your books can have serious consequences. So here are six tips to make bookkeeping as painless as possible!

1. Keep a Consistent Record of Your Expenses and Income

One of the most important things you can do when trying to get your finances in order is to keep a consistent record of your income and expenses. It may seem like a tedious task, but it is essential in helping you to track your spending and see where you can cut back.

There are several different ways to do this, but one of the simplest is to keep a running tally of what you spend each day. At the end of each month, you can then total your expenses and compare them to your income.

This will give you a good idea of where your money is going and help you to make changes where necessary. In addition, by tracking your spending, you can make sure that you are living within your means and avoiding debt.

2. Separate Business and Personal Finances as Much as Possible

As a small business owner, keeping your personal and business finances as separate as possible is essential. It can help you stay organized and avoid mixing up expenses.

Keeping separate bank accounts is an excellent way to start, and you should also get a business credit card that you use exclusively for work expenses. If you have employees, ensure they understand that personal costs should never be charged to the business credit card.

3. Make Sure All Transactions Are Documented

Keeping accurate records of all transactions is vital regardless of the type of business you are in. This includes sales, purchases, shipments, and payments.

Proper documentation not only helps to keep track of your finances, but it can also be helpful if there is a dispute. For example, if a customer claims they never received their purchase, having a transaction record can help resolve the issue.

However, this can also be time-consuming and complex, particularly if you have limited resources. In these cases, using bookkeeping services for small businesses can help you to identify areas where you may be overspending or spot opportunities for savings.

This way, you can free up time and focus on other aspects of your operation while ensuring that your financial affairs are in order.

4. Reconcile Your Bank Statements Regularly

As a small business owner, it’s important to reconcile your bank statements regularly. This process involves comparing your transaction records to your bank’s transactions. If there are any discrepancies, you’ll need to investigate and correct them.

Reconciling your statements can help you catch errors and prevent fraudulent activity. It can also help you keep track of your money and ensure that you’re spending appropriately.

5. Invest in Accounting Software to Make Bookkeeping Easier

In addition to keeping track of income and expenses, businesses must comply with a complex web of tax laws. As a result, many business owners choose to invest in accounting software. This software can automate many tasks associated with bookkeeping, such as invoicing and tracking payments.

The most popular accounting software programs offer a wide range of features, including tracking expenses, creating financial reports, and managing invoices. Some programs even offer features specifically designed for small businesses, such as tracking inventory levels or managing employee payroll.

They can also help you to stay on top of your tax obligations by generating reports and reminders. Investing in accounting software can save time and money and free up resources to focus on more critical tasks.

6. Set Aside Time Each Week or Month to Review Your Finances

No matter how busy you are, you must set aside time each week or month to review your finances. It will help you stay on top of your expenses and ensure that everything is accurate. In addition, you can save time and money in the long run by taking a few minutes to review your finances.

However, consider using bookkeeping services if you need help preparing your tax returns or other financial tasks. Bookkeepers can handle tasks such as tracking expenses, preparing financial statements, and keeping up with invoicing and payments. In addition, they can also provide valuable insight into ways to save money and improve your financial operations.

In conclusion, these six bookkeeping tips are essential for every business owner. We hope this article was helpful, and we wish you the best of luck in all your future endeavors!

SUBSCRIBE FOR MORE! HERE’S WHY:

1. You get 7 free books

2. You get the best money & productivity articles

3. You get the latest updates – all in one email per week

You have Successfully Subscribed!