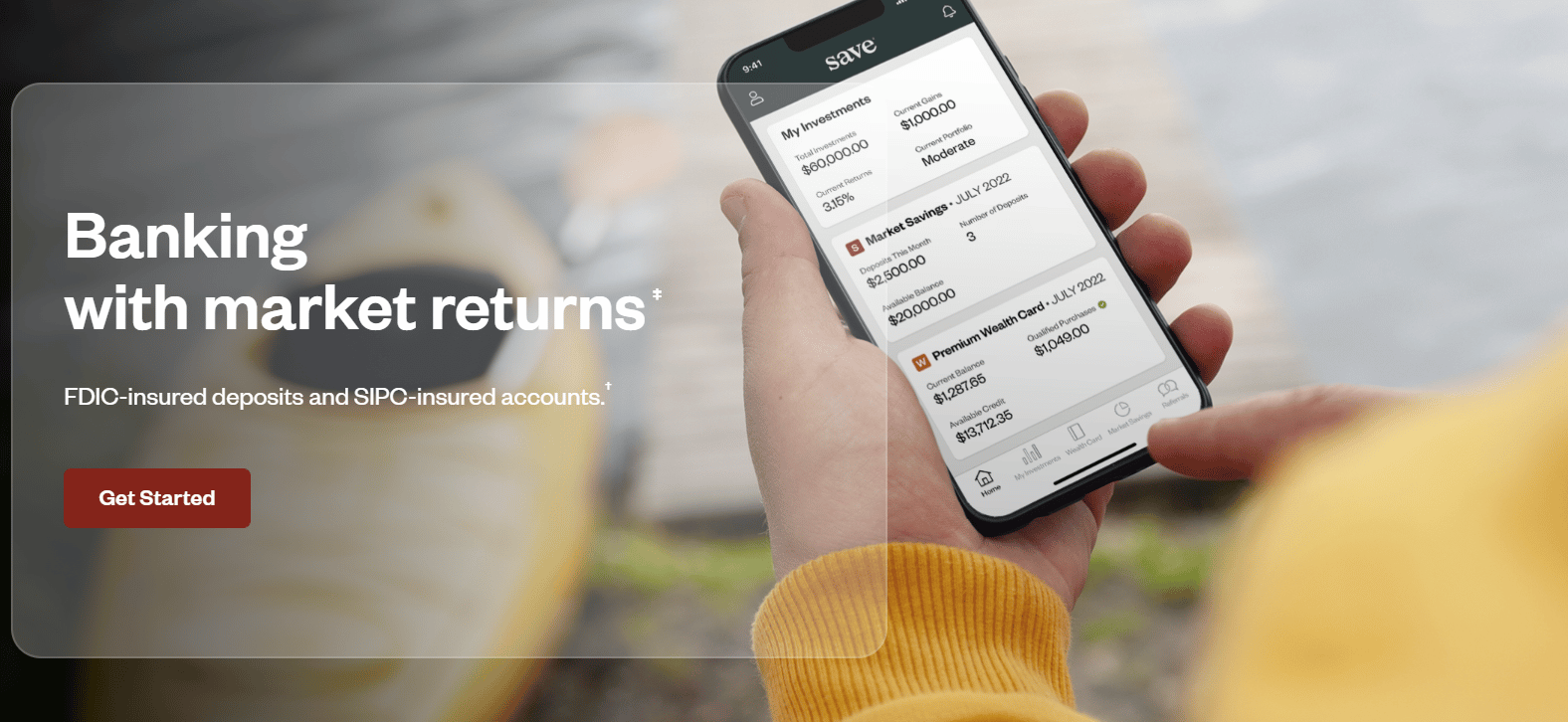

For those seeking alternative avenues to grow their wealth while safeguarding their hard-earned money, you could consider Save – a fintech platform that promises to revolutionize the way users save and invest.

Founded by industry veteran Michael Nelskyla and boasting partnerships with reputable institutions like Webster Bank, Gainbridge, and Apex Clearing, Save is poised to disrupt the financial landscape with extremely competitive variable APYs.

Intrigued by its potential, we decided to delve deep into Save’s features, including the account opening process, the pros and cons, safety measures, and overall impact on the financial market. Let’s take a look at our findings:

Key Features of The Join Save App

Save offers users a range of attractive features designed to optimize their savings potential and minimize risk of their investments. These include:

- Account Types: Users can choose between a variety of financial products, including their Market+, Market Savings and Market Trust, which allow you to pick an investment program that aligns best with your financial goals.

- Minimum Deposit: With a minimum deposit requirement of $1,000, Save is accessible to a wide range of investors.

- Fees: Market Savings has a 0.20% management fee. Referrals and other bonuses have 0.35%.

- Competitive APY: on 1-Year Term: Save offers a competitive variable APY of 9.07% on 1-year terms, providing the potential for substantial returns.

- Withdrawal Anytime: Users have the flexibility to withdraw their funds at any time, subject to advisory fees and account costs.

Once we had reviewed the key features, the allure of earning potentially high returns on both short and long-term investments intrigued us, prompting a closer inspection into the platform’s inner workings.

How Do You Open an Account With Save?

The Join Save app is available for download on both Apple and Google Play stores for all Android devices, iPhone and Mac. With just a few clicks, we were able to create a profile, select a deposit amount and choose an investment portfolio tailored to our financial goals. Here is how the process worked:

- Users begin by creating a profile on the Join Save platform, providing basic information such as name and contact details. (Note there are minimum eligibility requirements to apply including being at least 18 years of age, being a US citizen or permanent US resident, having a permanent US address and having a valid social security number).

- Users select their desired deposit amount, with a minimum requirement of $1,000.

- Save offers a range of investment portfolios tailored to different risk appetites and financial goals. Users choose the portfolio that best aligns with their investment objectives.

- Once the account setup process is complete, Save facilitates the opening of a non-interest bearing account at Webster Bank and an investment account at Apex Clearing.

- The funds are transferred from the customer’s existing bank to their Webster deposit account.

Review of The Join Save App – What Are Pros and Cons?

As with any financial platform, Save presents its fair share of pros and cons.

Save offers several benefits to users, including:

- With a market linked variable APY of 9.06%, Join Save provides users with the potential for substantial returns on their savings.

- Deposits are FDIC-insured up to the maximum amount allowed by law, providing users with peace of mind.

- Save offers a range of investment portfolios to suit different risk profiles, allowing users to diversify their holdings and optimize their investment strategies.

However, there are also potential drawbacks to consider:

- While Save’s variable APYs are competitive, they are subject to market fluctuations, which may impact overall returns. Returns are not guaranteed, and could be 0%.

- Users shoudl be aware that there may be costs associated with early withdrawl, potentially impacting the overall return on investment.

- As a relatively new product, there are limited Trustpilot reviews for Save.

What Safety Measures Does Save Have For My Investments?

One aspect of Save that stood out to us was its unwavering commitment to safety and security. Save prioritizes the safety and security of user funds, implementing robust measures to protect against unauthorized access and fraud that include:

- FDIC and SIPC Insurance: Save’s partnership with reputable institutions like Webster Bank and Apex Clearing ensures that user funds and investments are protected by FDIC and SIPC insurance coverage.

- Encryption: Save employs state-of-the-art encryption technology to safeguard sensitive user information and transactions, ensuring a secure and reliable platform for financial transactions.

Final Thoughts on Our Review of the Join Save App

Save represents a compelling option for individuals seeking to grow their wealth while minimizing risk. With competitive variable APYs, flexible account options and robust safety measures, Save offers users the opportunity to maximize their financial potential.

However, users should exercise caution and carefully consider their investment goals before investing with Save. Remain open to exploring traditional saving accounts in the market to make a considered judgment on the best financial product for you.

Editorial Disclaimer:

The views expressed in this article are solely those of the author and do not necessarily reflect the views of any financial institution, including Save. The author’s opinions are based on independent analysis and personal experiences. As with any financial decision, we recommend conducting thorough research and seeking advice from a qualified financial advisor before making any investment choices.